Analisa Pembahasan Manajemen

PT HARUM ENERGY Tbk

FY 2023 Summary and Highlights

Important Note: The results provided below reflect the unaudited consolidated results of PT Harum Energy Tbk. (“the Company”) for the full year ending 31 December 2023 (“FY 2023”), which include the results of PT Mahakam Sumber Jaya (“MSJ”), PT Layar Lintas Jaya (“LLJ”), PT Santan Batubara (“SB”), PT Karya Usaha Pertiwi (“KUP”), PT Bumi Karunia Pertiwi (“BKP”), PT Harum Nickel Perkasa (“HNP”), PT Tanito Harum Nickel (“THN”), PT Harum Nickel Industry (“HNI”), PT Infei Metal Industry (“IMI”), and PT Position (“POS”). The report below is prepared by the management and unaudited.

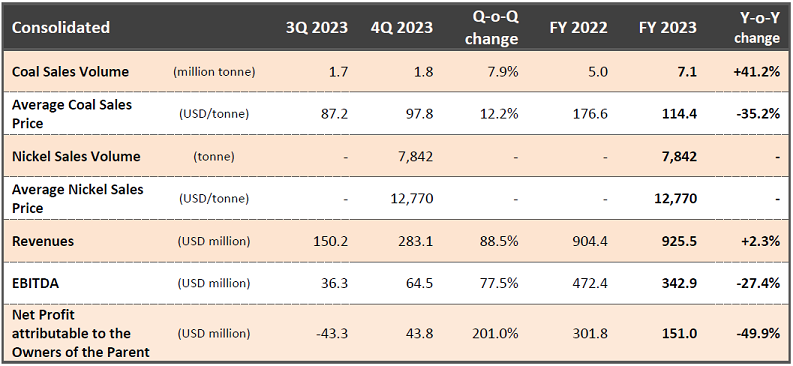

- Coal sales volume in 4Q 2023 totaled 1.8 million tonnes (Mt), or 7.9% higher quarter-on-quarter (q-o-q). For FY 2023, coal sales volume totaled 7.1Mt, or 41.2% higher year-on-year (y-o-y);

- Total consolidated revenues generated in FY 2023 is USD 925.5 million, or 2.3% higher y-o-y with EBITDA of USD 342.9 million or 27.4% lower y-o-y;

- The Company’s Average Coal Sales Price (ACSP) in 4Q 2023 is USD 97.8/t, or 12.2% higher q-o-q. The overall ASP achieved in FY 2023 decreased to USD 114.4/t or by 35.2% y-o-y from USD 176.6/t in the same period last year;

- The Company’s Average Nickel Sales Price (ANSP) in 4Q 2023 is USD 12,770/t;

- Total net profit attributable to owners of the parent in FY 2023 amounts to USD 151.0 million or 49.9% lower y-o-y, which includes one-off adjustment to the fair value of investments in FY 2023. Excluding such adjustment, the adjusted net profit attributable to owners of the parent in FY 2023 would have been approximately USD 220.0 million or 27.1% lower y-o-y.